Ether, Dogecoin Rally as XRP Soars 12% in Altcoin-Led Crypto Surge

Global risk appetite strengthened on Friday, with crypto, equities and gold futures all pushing higher, while oil headed for its steepest weekly decline since June.

Traders are balancing the tailwind from easing U.S.–Japan trade tensions against signals of cooling bitcoin (BTC) demand and heavier hedging in crypto options markets.

In broader Asian markets, The MSCI Asia Pacific Index added 0.5%, set for its fifth straight day of gains. Japan’s Nikkei-225 jumped 2.3% after chief trade negotiator Hiroshi Suzuki said the US had agreed to end stacking on universal tariffs and cut car levies concurrently.

Oil prices slipped toward a weekly drop of more than 4%, with Brent and WTI under pressure from rising US inventories and weaker Chinese import data, per Bloomberg.

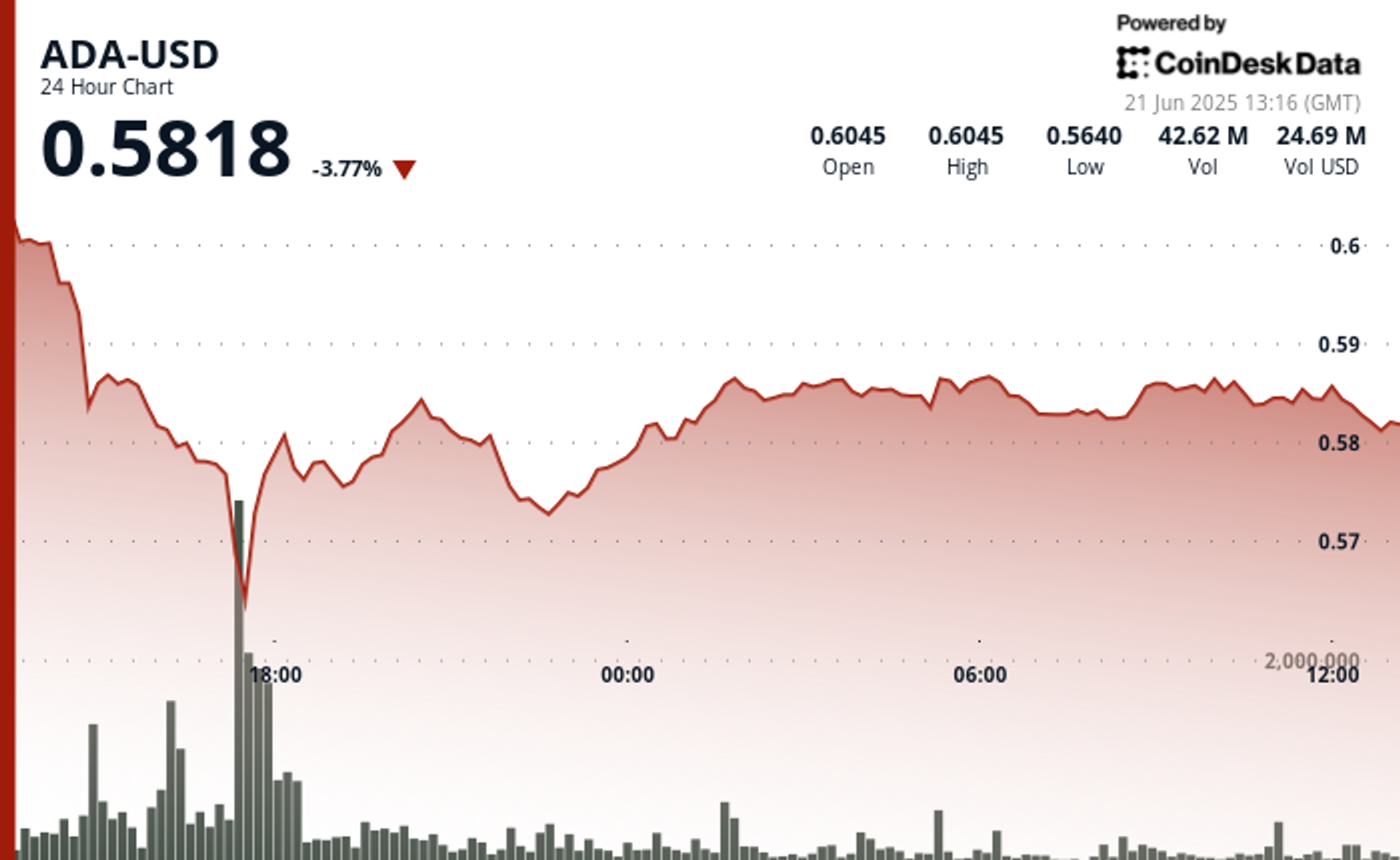

The total crypto market cap rose 3% to $3.76 trillion over the past 24 hours, led by major altcoins. Ether (ETH) gained 7.3% to $3,935, XRP (XRP) jumped 12% to $3.36, Solana (SOL) added 4.7% to $175.19, and dogecoin (DOGE) climbed 8.8% to 22 cents. Bitcoin lagged with a 1.9% rise to $116,781 on $38.8 billion in daily volume.

FxPro chief market analyst Alex Kuptsikevich said the rebound aligns with “growing appetite in the stock markets,” but warned that BTC is “trapped in a narrow range” between $112,000 support — the 50-day moving average and recent lows — and $120,000 resistance, defined by July highs and a psychological round number.

Meanwhile, Glassnode data signaled that BTC market sentiment has shifted from “euphoria” to “cooling off.” Spot Bitcoin ETF inflows have fallen nearly 25%, network activity is down, and transaction fees have dropped.

Options positioning points to increased hedging for BTC below $100,000 into late August, which could act as insurance amid expectations of a continual summer lull.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0