Asia Morning Briefing: Bitcoin Holds Steady as Traders Turn to Ethereum for September Upside

Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

Bitcoin is stuck in a holding pattern near $112,000, according to CoinDesk market data, but the bigger story onchain might be the divide emerging between how investors treat BTC and ETH heading into September. BTC is acting more like a macro hedge, while ETH is being positioned as the real vehicle for upside.

That split reflects a mix of policy uncertainty and shifting trader flows. In a recent note, QCP Capital wrote that doubts about the Fed’s independence are keeping term premiums elevated, a setup that weakens the dollar and supports hedges like BTC and gold.

But options desks and prediction markets show momentum gathering in ETH instead, where traders see the most potential for a breakout.

Flowdesk reported muted implied volatility in BTC despite pullbacks, suggesting positioning rather than speculative bets. Skew remains negative, meaning puts are expensive, but that creates relative value in call structures. ETH risk reversals, meanwhile, have recovered from their recent selloff, indicating renewed demand for upside exposure.

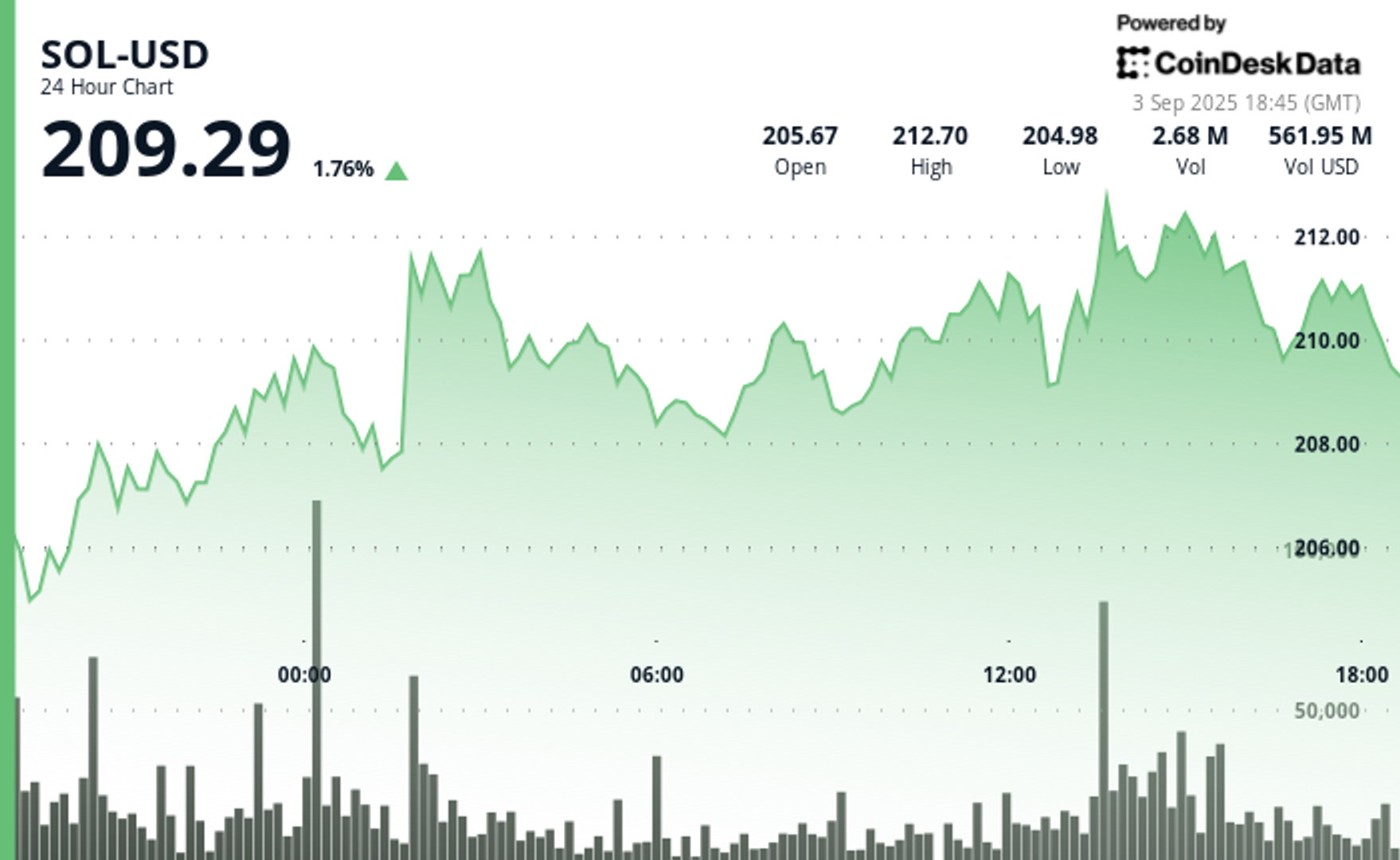

SOL options also saw increased activity, with flows skewed to the upside on growing sentiment around its ecosystem and corporate Digital Asset Treasury initiatives. Spot activity rotated into ETH beta names like AAVE and AERO, as well as SOL betas like RAY and DRIFT, showing breadth widening beyond majors.

Prediction markets back this rotation theme. Polymarket sentiment reinforces the rotation. Traders expect BTC to stay capped near $120k, while ETH is given a strong chance of breaking $5,000 — a view consistent with its 20% monthly rally and recovering risk reversals.

Traders are increasingly treating BTC as a steady macro hedge, while ETH is emerging as the market’s high-conviction upside play into September.

Europe-based market maker Flowdesk wrote in a recent Telegram update that activity on the desk remains high, with clients broadly positioned for upside even as macro risks linger and seasonal volatility tends to pick up.

The macro backdrop sets the hedge case, trading flows show how positioning is shifting, and prediction markets validate it with real-money bets. Together, they sketch a market where BTC anchors as a governance and inflation hedge, ETH leads on performance, and SOL builds momentum as breadth improves.

Market Movements

BTC: Bitcoin remains in a consolidation phase around the $110K–112K range, marked by waning short‑term volatility.

ETH: ETH is trading near $4400. Its rally is being fuelled by surging institutional interest, especially via ETF inflows, and anticipation surrounding the upcoming Fusaka network upgrade. Price action is supported by strong structural demand as ETH continues to solidify its role in DeFi and smart contracts.

Gold: Gold is trading around record highs propelled by expectations of an imminent Federal Reserve rate cut (markets now price in about a 92% chance), weakening confidence in Fed independence, and increased demand from ETFs and central banks acting as conviction buyers.

Nikkei 225: Asia-Pacific stocks climbed Thursday, led by a 0.57% gain in Japan’s Nikkei 225, as Wall Street’s tech rally lifted sentiment despite lingering economic worries.

S&P 500: U.S. stocks rose Wednesday as Alphabet gained after avoiding a breakup in an antitrust ruling and investors boosted September Fed rate-cut bets despite fresh labor market concerns.

Elsewhere in Crypto:

- U.S. CFTC Gives Go-Ahead For Polymarket's New Exchange, QCX (CoinDesk)

- Pump.fun’s New Fee Model Hands Out $2M to Creators in First 24 Hours (Decrypt)

- AI Agents Will Become Biggest Stablecoin User, Says Novogratz (Bloomberg)

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0