Why Lightning Network capacity declining 20% in 2025 is NOT as bad as it sounds

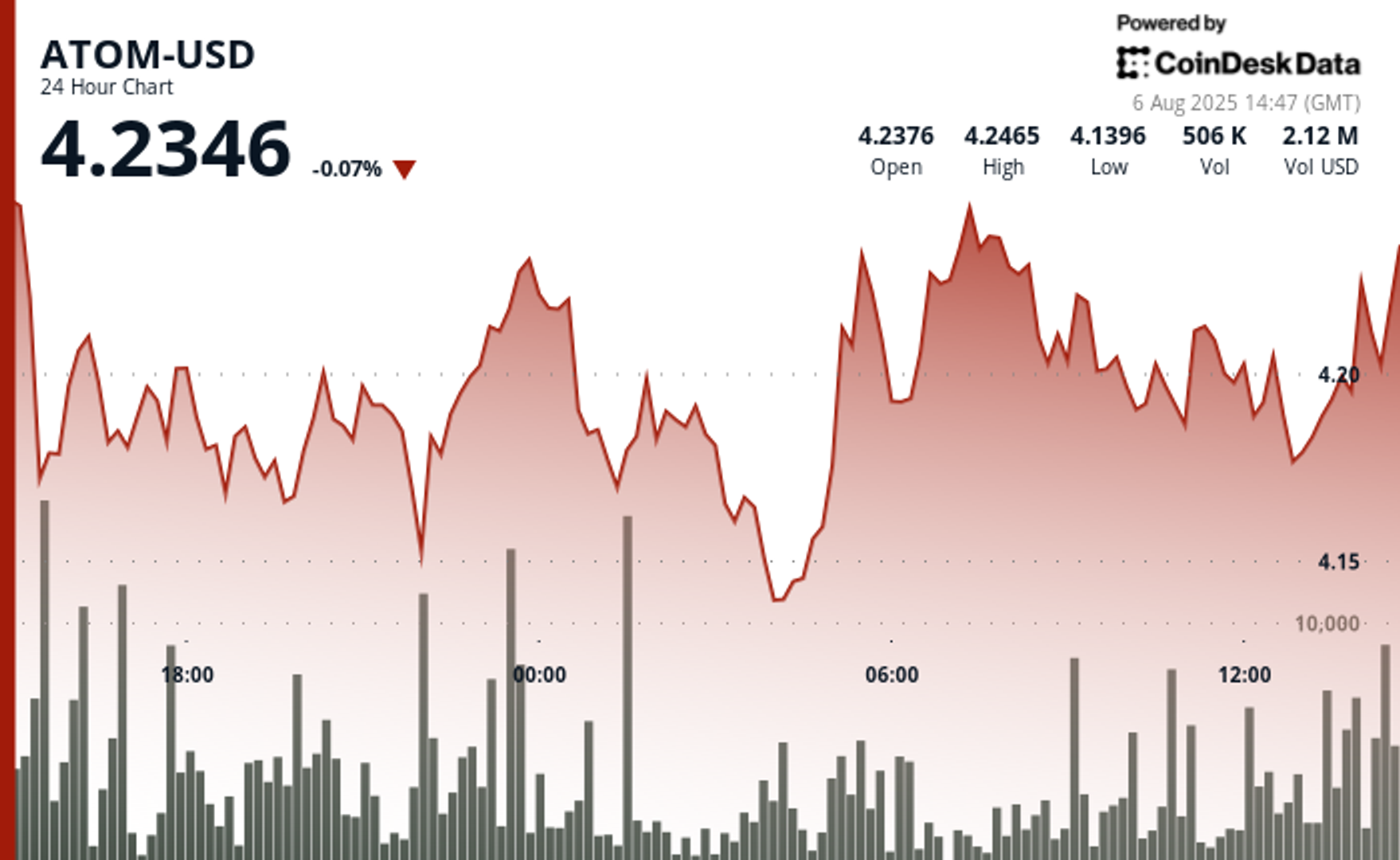

Bitcoin’s Lightning Network capacity has declined from over 5,400 BTC in late 2023 to around 4,200 BTC by August 2025, a roughly 20% drop, per mempool.space data. While the raw figures imply a contraction, analysts and developers suggest the shift reflects structural evolution in routing and protocol design rather than a retreat in adoption.

Lightning capacity vs usage

The network’s capacity metric refers to the total amount of BTC locked in publicly advertised payment channels, which form the graph used to route peer-to-peer transactions.

As River’s 2023 Lightning report explains, this number does not reflect private channels, custodial flows, or multi-path routed payments. The same report found that despite only moderate growth in capacity at the time, routed payments on Lightning increased 1,212% between August 2021 and August 2023.

Coinbase’s integration of Lightning in 2024 brought measurable volume. By mid-2025, Lightspark reported that roughly 15% of Bitcoin withdrawals on the platform were now routed via Lightning.

CoinGate, a European crypto payments processor, has also reported that Bitcoin’s share of crypto payments on its platform regained dominance in 2025, with internal data attributing part of that volume to growing use of second-layer networks, including Lightning. In its 2024 quarterly breakdown, CoinGate noted that Lightning had already accounted for over 16% of all Bitcoin orders, up from around 6.5% two years earlier.

The decline in public capacity accompanies a longer-term drop in public node and channel counts, which have been in steady decline since 2022, according to data from mempool.space.

Developers attribute part of this trend to the consolidation of routing through better-managed hub nodes and the adoption of protocol enhancements like channel splicing. These changes allow wallets to resize channels without on-chain transactions, reducing the need for new channels and enabling more efficient use of liquidity.

Continued Lightning development

While the public graph may appear smaller, recent developments may be expanding the scope of the network’s use cases. In January 2025, Tether announced the rollout of USDt over Lightning via Taproot Assets, in collaboration with Lightning Labs.

This opens the door to dollar-denominated payments and stablecoin-backed remittances on the network, which would not require BTC to be locked in channels, effectively decoupling usage from Bitcoin-denominated capacity metrics. Lightning Labs CEO Elizabeth Stark said the integration combines the security of Bitcoin with the speed and scalability of Lightning.

At a structural level, developers are also addressing issues that affect payment reliability and channel health. Research on jamming attacks and replacement cycling vulnerabilities continues through the Bitcoin Optech working groups, while features like BOLT12 Offers and liquidity automation tooling are making Lightning more robust for commercial usage.

There is also a noticeable expansion in application layers using the Lightning protocol. One example is L402, a specification that enables pay-per-request APIs using Lightning-native authentication and micropayments, now deployed in early AI agent stacks such as LangChainBitcoin.

The design enables automated agents to pay per inference call or API response without requiring fiat accounts or static keys, offering a new machine-to-machine payment stream that does not rely on capacity growth to scale.

These protocol and use-case shifts provide context for why public capacity alone may no longer be a complete indicator of the network’s adoption trajectory.

Developers argue that Lightning’s current evolution is less about growing visible liquidity and more about increasing the utility of each satoshi already in motion.

While the public capacity trendline may be descending, the underlying metrics on usage, integration, and technical progress tell a different story.

The post Why Lightning Network capacity declining 20% in 2025 is NOT as bad as it sounds appeared first on CryptoSlate.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0