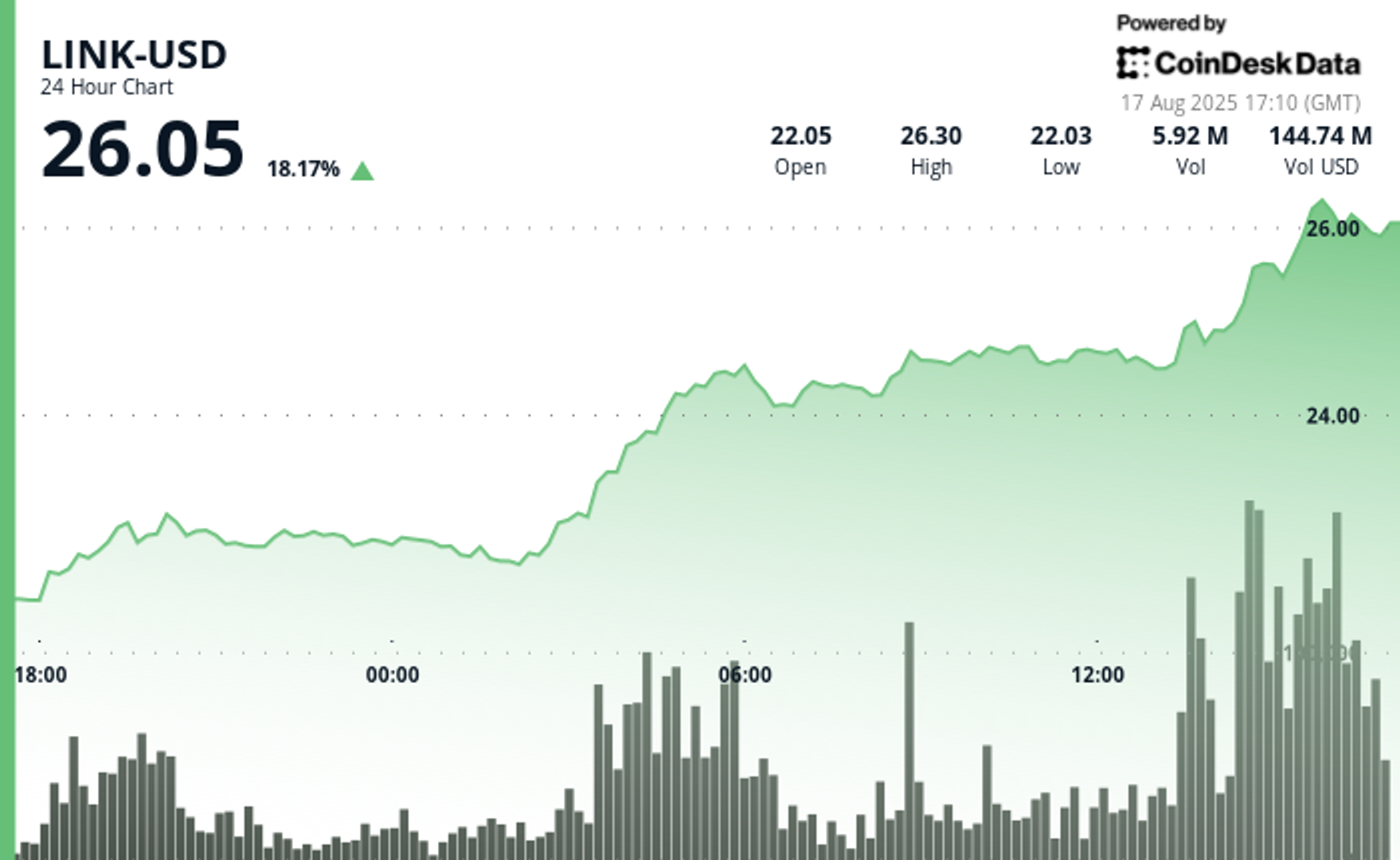

Cardano’s ADA Rises as Altcoin Trading Volume Surges Amid Broader Rally

Cardano's native token (ADA) rose more than 6% over the past 24 hours as trading volume spiked overnight amidst a broader crypto rally.

Market analysts remain divided on ADA's short-term prospects. While some point to a potential bullish reversal with targets around $0.70-$0.72, others note bearish on-chain metrics, including declining active wallets and substantial exchange outflows.

The broader economic landscape continues to influence crypto markets, with President Trump's firm stance on tariffs creating additional uncertainty. As July unfolds, investors are closely monitoring both technical indicators and macroeconomic developments that could determine whether ADA's recent volatility represents the beginning of a recovery or merely a temporary bounce.

Technical analysis highlights

- The asset established a strong uptrend, reaching a peak of $0.611 at 08:00 UTC, marking a 5.69% increase from the period's opening price of $0.578, according to CoinDesk Research's technical analysis data.

- High volume support emerged around the $0.590 level during the 05:00 UTC hour when buying pressure propelled ADA upward on above-average volume of 48 million.

- The subsequent pullback found resistance at $0.609 during the 12:00 hour with elevated volume of 81.6M, suggesting profit-taking after the rally.

- During the 60-minute period from July 3, 14:50 to 15:49 UTC, ADA experienced significant downward pressure, declining from $0.599 to $0.589, representing a 1.7% loss.

- A sharp sell-off occurred at 15:35 when the price plummeted to $0.589, accompanied by an extraordinary volume of 7.5M, establishing a clear support zone.

- The asset attempted recovery between 15:36 and 15:42 UTC, forming a minor consolidation pattern around $0.591, but failed to sustain momentum as selling pressure resumed.

- The final minutes showed signs of potential reversal with price bouncing from the session low of $0.588 to close at $0.589, suggesting possible exhaustion of short-term bearish momentum.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0